Keeping Track Of Your Business Operations… And Your Social Security Retirement Options Plus, Get The Most Production Out Of Your Staff With Enhanced Listening Skills

Accept Changing Circumstances

Accept Changing Circumstances

With A Smile & A Positive Attitude

As we all know, in life nothing stays the same forever. Of course, the same is true in Business. Changes can bring its challenges and it can also bring excitement and growth.

Aiden, is now in the first grade making new friends and all that goes on with being a full-time student. He’s playing basketball, swimming and of course loves playing the violin. Needless to say, he has a full schedule to manage. One of the biggest events is the recent addition of my new grandson and Aiden’s new brother Leo. I am so proud of the way he has accepted his new brother. Often when there is a new edition to the family, they can steal the spotlight and that can make it rough for the family dynamics, especially if you just focus on yourself instead of the family as a whole.

I seem to be learning life lessons from Aiden both personally and professionally.

INSIDE THIS ISSUE

• Optimizing Social Security Benefits

• Why You Should Be A Better Listener At Work and the Do’s and Don’ts of Listening Skills

• The Break-Even Age On Social Security

• KPI’s And Dashboards – What Is Optimal?

REVIEW

“It is a pleasure to work with Tim. He readily relies on his strong overall business acumen to align, translate and communicate strategic activates into expected financial outcomes. In addition, he identifies and executes key day to day activates to achieve desired financial outcomes. Tim is able to roll up his sleeves and dig into details as well as provide key summaries. He has been an asset to our organization and would be a great addition as a CFO on demand for your company.”

Jeff Minnick – Board Member –

Hitchcock Center For Woman

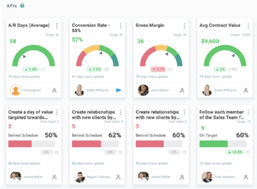

KPI and Your Business Performance At A Glanc

6 Benefits Of KPI Dashboards:

Today, users benefit from advanced analytics solutions for data analysis. Yet, for operational needs, a unified KPI dashboard remains a valuable BI tool, providing quick answers to high-level performance questions.

1. Detailed Analysis: Organize, filter, and visualize key targets interactively, simplifying complex data.

2. Scale Issue Detection: Easily identify met targets and prioritize actions with organized dashboards.

3. Efficient Decision-Making: Centralize critical operational data, enhancing visibility and efficiency.

4. Enhanced Collaboration: Foster teamwork with shared visual progress tracking and accessibility.

5. Real-Time ROI Analysis: Monitor performance metrics instantly for proactive decision-making and improved financial outcomes.

6. Opportunity Discovery: Identify trends and opportunities, refining objectives for enhanced business performance.

KPI Dashboards

KPI Dashboards come in all sizes shapes and formats. Some can be customized to suit your needs while others provide templates for easy access to performance indicators.

KPI dashboards allow users to organize, filter, drill down, analyze and visualize their most important key targets for any given business area or project in a highly interactive way, which typically helps translate large, complex data into an easy-to-understand format, instead of having to wade through tons of separate data in multiple programs.

Top 7 Top KPI Software Solutions

1. Domo:

Pros: Extensive integration options, with 700+ pre configured API. Connectors. Includes a mobile app for on-the go data management.

Cons: Some find custom report creation time-consuming. Format, challenging for Excel users.

2. Smartsheet:

Pros: Easy tracking of data changes. Automatic reminders for updates. Document attachment capability.

Cons: Lacks clear alignment of projects/KPIs with strategic goals. Formatting and data manipulation limitations. Single person assignment per task. Limited reports.

3. ClearPoint:

Pros: Links KPIs to organizational goals. User-friendly interface; no need for IT involvement. Automates data collection, analysis, and report generation.

Cons: Does not track daily transactional data.

4. KPI Fire:

Pros: Ensures project alignment with long-term goals. Facilitates dashboard integration for progress monitoring. User friendly interface.

Cons: Limited data analysis features. Reports may lack aesthetic appeal.

5. Power BI:

Pros: Excellent for analyzing transactional data and deriving insights. Capable of handling large data volumes. Offers a wide array of data visualization options.

Cons: Limited ease of importing data from manual or

ad-hoc sources. Challenges in capturing qualitative analysis and recommendations.

• Lacks visibility into the connection between KPIs and strategic goals.

6. Tableau:

Pros: Abundant chart and dashboard choices. Simple drag- and drop dashboard editing.

Cons: Challenging for non-technical users or those lacking deep data knowledge. Not optimized for real-time data updates. Loading times slow for large datasets.

7. Qlik:

Pros: AI aids in dashboard creation, enhancing data comprehension. Generally perceived as user friendly.

Cons: Limited visualization options. Insufficient support and documentation.

CERTIFIED PUBLIC ACCOUNTANT

Tim has been in accounting since 1988 and specializes in strategic planning to help small business clients achieve their goals. Through helping establishing these goals and objectives of our clients, we focus on the key performance indicators that will help drive performance and improve bottom line results. Tim has extensive experience in retail, healthcare, non profit, and public accounting.

Tim has been in accounting since 1988 and specializes in strategic planning to help small business clients achieve their goals. Through helping establishing these goals and objectives of our clients, we focus on the key performance indicators that will help drive performance and improve bottom line results. Tim has extensive experience in retail, healthcare, non profit, and public accounting.

Tim has an innate ability to cut through the noise and discover the true cause of the problem. He is an expert at implementing cost effective solutions to improve profit and eliminate the source of problem.

Bank Reconciliation

Successful businesses know and monitor their numbers. Having this information in a timely manner can save you a lot of stress, grief and potentially hundreds or thousands of dollars.

Don’t be lazy on this.

• Yes, you need to reconcile your account(s) every month!

• A separate person from the one paying the bills needs to be doing this.

• Helps prevent fraud.

• Positive pay on your account to avoid fraud.

• All accounts with payments should be reconciled

i. Line of credit

ii. Credit cards

Top 5 Reasons Why You Should Be A Better Listener At Work

1. Listening fosters a positive work environment by demonstrating respect and empathy towards employees.

2. When bosses actively listen to their team members, it promotes trust, boosts morale, and encourages open communication.

3. Being attentive to employee concerns and ideas can lead to more effective problem-solving and innovation within the organization.

4. Improved listening skills also enable bosses to better understand the needs and perspectives of their employees, which can contribute to stronger relationships and increased employee satisfaction.

5. Ultimately, bosses who prioritize listening create a culture of col-laboration, empowerment, and mutual respect, leading to higher productivity and overall success within the workplace.

Listening Skills: Are You Bad Or Good?

What Makes Someone a Bad Listener?

1. Not paying attention. Avoid distractions. Losing focus during conversations signals disinterest to the speaker

2. Avoid interjecting personal anecdotes. While it may seem sympathetic, it can detract from the speaker’s story.

3. Judging the speaker. Individuals often disengage or become defensive when confronted with opposing viewpoints. preventing the opportunity for a meaningful exchange of ideas.

4. Not asking questions. Failing to ask questions suggests poor listening; questioning demonstrates engagement and validation.

5. Avoid interrupting: Effective listeners rarely interject their opinions while someone else speaks. Refrain from cutting off others; it may imply your perspective is more important.

6. Planning your response while the speaker talks. This distracts from listening, harming relationships as it appears self-focused, possibly discouraging future conversations.

How To Improve Your Listening Skills:

1. Practice active listening: Focus entirely on the speaker, showing genuine interest through verbal and nonverbal cues. Allow the speaker to express themselves fully before contributing.

2. Offer support. Refrain from interrupting with your own thoughts or solutions. Avoid minimizing their emotions or struggles. When someone confides in you, offer reassurance.

3. Remain open-minded. Listen without interjecting your perspective, even if the topic is uncomfortable. Empathy requires patience and understanding.

4. Mentally note important details. And repeat last words. Remember key points, clarify any confusion, stay engaged, wait to respond.

5. Ask questions. This establishes engagement and attentiveness. Use clarifying questions for comprehension and probing questions for deeper insights. Keep questions supportive to avoid interrogation.

6. Practice active listening exercises. Write summaries after conversations to stay engaged and improve your skills.

7. Use positive body language. Face the speaker, maintain eye contact, and avoid negative movements. Show engagement with nods and be mindful of facial expressions to avoid judgment.

Optimizing Social Security Benefits

Married couples have more options in Social Security due to differing claiming dates and spousal benefits. Strategic planning is crucial for optimizing benefits, including delaying claims for higher payments and considering spousal benefits for earnings disparities.

Postponing benefit claims past age 62, up to age 70, can result in up to an 8% increase in future monthly payments. However, maximizing benefits may require short-term sacrifice.

Ann Dowd, a Certified Financial Planner and vice president at Fidelity, emphasizes the importance of maximizing Social Security benefits to mitigate the risk of outliving retirement savings, particularly as life expectancy increases.

Couples can choose to claim benefits based on their individual work records or up to 50% of their spouse’s benefit at full retirement age, known as a spousal benefit. Particularly for couples with significant earnings disparities, opting for the spousal benefit may be more advantageous than claiming their own benefits.

Couples can choose to claim benefits based on their individual work records or up to 50% of their spouse’s benefit at full retirement age, known as a spousal benefit. Particularly for couples with significant earnings disparities, opting for the spousal benefit may be more advantageous than claiming their own benefits.

Moreover, Social Security payments are dependable and typically adjust for inflation through cost-of-living increases, providing a valuable stream of inflation-protected income, especially considering longer life expectancies today. However, capitalizing on higher monthly benefits may necessitate short-term sacrifice, as initial Social Security income may be lower to secure larger payments later in retirement.

ESTIMATING LIFE EXPECTANCIES TO MAXIMIZE PAYOUT

A critical consideration for couples is estimating their individual life expectancies. Delaying Social Security yields higher payouts but requires time to compensate for lower early payments.

Longevity trends indicate that people are living longer than anticipated, with current statistics suggesting that a 65-year-old man may live to 87 on average, while a woman of the same age may live to 89 on average.

In the event of a spouse’s death, the surviving spouse can claim the higher monthly benefit for the remainder of their life, deferring the benefit of the higher earner a viable strategy. Conversely, if both partners have health concerns indicating shorter life expectancies, claiming benefits early may be more prudent.

At What Age Do You

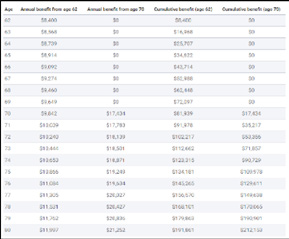

Break Even On Social Security?

If your goal is to optimize your Social Security benefits over your lifetime, you may want to conduct a break-even analysis to determine the most advantageous time to file your claim. Essentially, this analysis helps you ascertain whether it’s more beneficial to claim early, receiving smaller payments over a longer period, or to delay claiming until later, thereby receiving larger payments for a shorter duration.

If your goal is to optimize your Social Security benefits over your lifetime, you may want to conduct a break-even analysis to determine the most advantageous time to file your claim. Essentially, this analysis helps you ascertain whether it’s more beneficial to claim early, receiving smaller payments over a longer period, or to delay claiming until later, thereby receiving larger payments for a shorter duration.

Let’s simplify the scenario by assuming your full retirement benefit amounts to $1,000. Additionally, we’ll consider a 2 percent annual increase in benefits, applied both to the actual paid benefit starting at age 62 and to the accumulated benefit to be claimed later at age 70.

At age 62, your initial monthly benefit would be 30 percent lower than your full benefit, totaling $700. Conversely, at age 70, your benefit would amount to $1,240, with adjustments made for any cost-of-living increases during the interim period.

Here’s a breakdown of the numbers and the determination of a break-even age for claiming Social Security.

Around the age of 78, those who choose to file for Social Security benefits later surpass those who file earlier in terms of the total amount received from the program. Beyond this point, the later filer consistently withdraws at least $9,000 more annually compared to the earlier filer, equating to an additional $750 per month.

Clearly, for individuals anticipating a longer lifespan, delaying the filing of Social Security benefits emerges as the superior option.