Dear Valued Client,

This month’s newsletter covers some of the new advantageous tax credits, important news for those who filed with unemployment income, tax tips for your startup business expenses, an inspiring entrepreneur success story, information about Qualified Small Business Stock gain exclusion, and the latest on the tax gap and possible future compliance crackdowns.

With so many late tax law changes, new rulings, and tax complexity affecting both individuals and business owners, it is critical you talk to us before making any significant tax or business decisions.

If you or your colleagues, family, or friends need help, we are here for you. We will continue our efforts to monitor the latest opportunities aimed at keeping all of our clients prosperous. Your kind reviews and referrals are appreciated.

IRS to Automatically Adjust Prior Filed 2020 Returns with Unemployment Income

Article Highlights

• Prior Filed Returns with Unemployment Income

• American Rescue Plan’s $10,200 Exclusion

• IRS Automatic Adjustment

• Refund Application

• When an Amended Return Might Be Required

The IRS announced on March 31, that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent law change made by the American Rescue Plan Act.

The IRS announced on March 31, that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent law change made by the American Rescue Plan Act.

The American Rescue Plan Act, signed on March 11, allows each taxpayer who earned less than $150,000 in modified adjusted gross income to exclude up to $10,200 of unemployment compensation from taxation. Since it applies to each taxpayer, married couples where both spouses received unemployment benefits may be able to exclude up to $20,400 if married filing status. The legislation excludes only 2020 unemployment benefits from taxes.

Because the change occurred after some people filed their taxes, the IRS will take steps in the spring and summer to make the appropriate change to the returns of these individuals, which may result in a refund. The first refunds are expected to be made in May and will continue into the summer.

For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation, the IRS will determine the correct taxable amount of unemployment compensation and tax. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed. For those who have already filed, the IRS will do these recalculations in two phases, starting with those taxpayers eligible for the up to $10,200 exclusion. The IRS will then adjust returns for those married filing jointly taxpayers who are eligible for the up to $20,400 exclusion and others with more complex returns.

There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

For example, the IRS can adjust returns for those taxpayers who claimed the Earned Income Tax Credit (EITC) and, because the exclusion changed the income level, may now be eligible for an increase in the EITC amount which may result in a larger refund. However, taxpayers would have to file an amended return if they did not originally claim the EITC or other credits but now are eligible because the exclusion changed their income.

If you have questions, please give this office a call.

SBA Raises Loan Limit For COVID-19 EIDL Loans to $500,000

As U.S. businesses continue to recover from COVID-19’s economic devastation, the U.S. Small Business Administration (SBA) is expanding loan opportunities. The agency announced that beginning the week of April 6th, nonprofits and small businesses will be able to borrow up to $500,000 for up to 24 months. This expansion of the COVID-19 Economic Injury Disaster Loan (EIDL) program more than triples the existing limit of six months and a maximum loan amount of $150,000.

As U.S. businesses continue to recover from COVID-19’s economic devastation, the U.S. Small Business Administration (SBA) is expanding loan opportunities. The agency announced that beginning the week of April 6th, nonprofits and small businesses will be able to borrow up to $500,000 for up to 24 months. This expansion of the COVID-19 Economic Injury Disaster Loan (EIDL) program more than triples the existing limit of six months and a maximum loan amount of $150,000.

In a news release announcing the change, SBA Administrator Isabella Casillas Guzman said, “More than 3.7 million businesses employing more than 20 million people have found financial relief through SBA’s Economic Injury Disaster Loans, which provide low-interest emergency working capital to help save their businesses. However, the pandemic has lasted longer than expected, and they need larger loans.”

Businesses that had already applied for a COVID-19 EIDL loan need not worry about reapplying, as all applications in process will automatically be considered for the increased amounts. Similarly, instructions will be published to allow those who have already been approved for a loan to apply for the expanded amounts. A loan increase can be requested via SBA.gov, and an email will go out to all previously approved borrowers containing the same information.

The COVID-19 EIDL program has been extremely successful, with over $200 billion in loans already approved by the SBA. Small businesses, including independent contractors and sole proprietors, have been provided 30-year maturity loans at a 3.75% interest rate, while not-for-profits will pay 2.75% in interest.

In more good news for borrowers, on March 12th the SBA announced that borrowers for all disaster loans, including the COVID-19 EIDL loans, would be provided extended deferment periods. Interest will still accrue on all outstanding loan balances, so though payments are not required until 2022, borrowers do have an incentive to begin paying their balance off sooner.

If you have any questions about the EIDL loan limit expansion and how it could affect your business, please contact our office.

Owe Taxes and Can’t Pay by the Due Date?

Article Highlights:

• If you can’t pay

• Loans • Credit card payments

• IRS Installment agreement

• Retirement funds

The vast majority of Americans get a tax refund from the IRS each spring, but what if you are one of those who end ends up owing?

The vast majority of Americans get a tax refund from the IRS each spring, but what if you are one of those who end ends up owing?

The IRS encourages you to pay the full amount of your tax liability on time by imposing significant penalties and interest on late payments if you don’t. So if you are unable to pay the tax you owe, it is generally in your best interest to make other arrangements to obtain the funds for paying your taxes rather than be subjected to the government’s penalties and interest. Here are a few options to consider. Although they all have negative connotations, they are all better than the penalties and interest the IRS could impose, not to mention the time and headache of dealing with IRS communications and the possibility of wage, bank account and asset levies.

• Family Loan — Obtaining a loan from a relative or friend may be the best bet because this type of loan is generally the least costly in terms of interest.

• Credit Card — Another option is to pay by credit card with one of the service providers that works with the IRS. However, since the IRS will not pay the credit card discount fee, you will have to pay it and pay the higher credit card interest rates.

• Installment Agreement — If you owe the IRS $50,000 or less, you may qualify for a streamlined installment agreement where you can make monthly payments for up to six years. You will still be subject to the late payment penalty, but it will be reduced by half. Interest will also be charged at the current rate, and there is a user fee to set up the payment plan. In making the agreement, you will have to agree to keep all future years’ tax obligations current. If you don’t make your payments on time or have an outstanding past due amount in a future year, you will be in default of the agreement and the IRS has the option of taking enforcement actions to collect the entire amount owed. If you will be seeking an installment agreement exceeding $50,000, you will need to validate your financial condition and the need for an installment agreement by providing the IRS with a Collection Information Statement (financial statements). You may also pay down the balance due to $50,000 or less to take advantage of the streamlined option.

• Tap a Retirement Account — This is possibly the worst option for obtaining funds to pay your taxes because you are jeopardizing your retirement and the distributions are generally taxable at your highest bracket, which adds more taxes to your existing problem. In addition, if you are under age 59½, the withdrawal is also subject to a 10% early withdrawal penalty that compounds the problem even further.

If you would like to discuss your options, please give this office a call.

Here’s What Happened in the World of Small Business in April 2021

Here are five things that happened this past month that affect your small business.

Here are five things that happened this past month that affect your small business.

1) President Biden announced tax credits for COVID-19 vaccination paid time off. The President announced on April 21st “tax credits for certain businesses that pay employees who take time off to get COVID-19 shots, a new effort to involve corporate America in his vaccination campaign.” The tax credits will be applicable for businesses with fewer than 500 employees. (Source: Reuters)

Why this is important for your business: Providing your employees with paid time off to get their vaccine will now be covered by the government, so you can encourage vaccinations if you choose without taking on the cost of offering additional PTO.

2) Workers at an Amazon warehouse in Alabama voted not to unionize, but the company is being accused of violating laws. The union vote we discussed last month has been completed, and workers at the Amazon fulfillment center in Bessemer, Alabama voted not to unionize. This was seen as a win for Amazon; however, the union that led the drive “has filed challenges over the vote, saying the company violated legal restrictions throughout the election.” (Source: The Wall Street Journal)

Why this is important for your business: This union push caught the attention of workers, unions, businesses, and government officials, and the story isn’t over yet. Additionally, other groups across the US have already started announcing their goals to unionize, inspired by the push in Bessemer. No matter your views on organized labor, keep paying attention to this story.

3) Businesses across the world are bracing (and hoping) for an impending post-pandemic “spending boom.” Could we be in the beginning stages of a global spending spree? “Consumers around the world have amassed an extra $5.4 trillion in savings since the coronavirus pandemic began, setting the stage for a spending boom that could power a strong uplift in economic growth this year.” (Source: CNN Business)

Why this is important for your business: Revenue, revenue, revenue.

4) Small businesses can get another $500k from the Small Business Administration (SBA). Beginning April 6th, the SBA expanded its Economic Injury and Disaster Loan (EIDL) program. “Small businesses who originally took out an EIDL loan for up to $150,000 for six months can extend that loan for up to 24 months and receive additional funds for a total of $500,000 in relief.” Additionally, the deferment period for both Paycheck Protection Program (PPP) and EIDL loans was extended through 2022. (Source: Yahoo! Finance)

Why this is important for your business: If your small business is still struggling financially and you need additional funding, the EIDL expansion could help.

5) The conversation around corporate taxation (and large firms who pay $0 in taxes) is growing louder. A report from the nonpartisan Institute on Taxation and Economic Policy found that “55 of the largest firms in the country used a complex roadmap of tax breaks and loopholes to bring their tax bill down to zero, despite turning millions, or even billions in profit.” (Source: Fast Company)

Why this is important for your business: This finding has added fuel to the conversation around corporate taxation – or a lack thereof – in the US. Keep an eye on the public discourse and any moves made by politicians to speak on this topic in the coming months.

You Can Expense Business IT Purchases

Article Highlights:

• Depreciation

• Material & Supply Expensing

• De Minimis Safe Harbor Expensing

• Routine Maintenance

• Bonus Depreciation

• Section 179 Expensing

Thanks to some very liberal tax laws written to encourage investment in personal tangible equipment, including information technology (IT) equipment, many businesses will be able to expense (write off as a tax deduction) all such assets purchased and placed in service before the end of the tax year.

Thanks to some very liberal tax laws written to encourage investment in personal tangible equipment, including information technology (IT) equipment, many businesses will be able to expense (write off as a tax deduction) all such assets purchased and placed in service before the end of the tax year.

For businesses using the accrual method of accounting, the purchase must have been completed and the equipment placed in service before the company’s year-end. There are a number of ways to deduct IT costs, and the best method should be based upon the need for a current-year deduction, while also considering that the deductions may be more beneficial in a future year. So careful planning is required.

• Depreciate — The most conservative method of writing off the investment would be to depreciate the various pieces of equipment over the recovery period (useful life), designated by the IRS as being either 5 or 7 years, depending on the individual items. Generally, computers, copiers, and certain technological and research equipment are depreciated over 5 years, while office fixtures, furniture, and equipment are depreciated over 7 years.

• Material & Supply Expensing — Capitalization and repair regulations may come into play with what is called material or supply expensing. If an item costs $200 or less or has a useful life of less than one year, it is expensed rather than depreciated.

• De Minimis Safe Harbor Expensing — Another part of the capitalization and repair regulations allows businesses to expense up to $2,500 of equipment ($5,000 if the business has an applicable financial statement). The limits are applied per item or per invoice, which provides a significant amount of latitude in expensing.

• Routine Maintenance — The expenditure can be expensed if the purchase is used to keep a unit of property in operating condition and the business expects to perform the maintenance twice during the property’s class life (different than depreciable life). The class life for information systems and computers is 6 years.

• Bonus Depreciation — Bonus deprecation allows a business to deduct 100% of the cost of new tangible property with a recovery period of 20 years or less if it is placed in service during 2020. 100% bonus depreciation will begin to phase out after 2022.

• Section 179 Expensing — Sec. 179 of the Internal Revenue Code allows full expensing of IT equipment purchases. Commonly referred to as the Sec. 179 deduction, for 2021, it allows companies to expense up to $1,050,000 ($525,000 for a married taxpayer filing separate) up from $1,040,000 (and $520,000) for purchases in 2020 of personal tangible equipment, including IT equipment. The stated amounts are for federal purposes (state limits may be different). There is an aggregate investment limit of $2,620,000 (up from 2,590,000 in 2020), which means if the company makes investments into property eligible for Sec. 179 expensing in excess of $2,620,000 in 2021 ($2,590,000 for 2020 purchases), the amount allowed to be expensed under Sec 179 is reduced by one dollar for each dollar the investment limit is exceeded. These amounts are inflation-adjusted annually. There are negative factors to using Sec. 179 expensing. If the item is disposed of before the end of its recovery period, the expense deduction is recaptured, to the extent that it exceeds the otherwise allowable depreciation deduction for the period. The recaptured amount is added to the business’s income for the disposition year. For very large companies, the use of Sec. 179 is restricted because of the annual limit.

• Blended Methods — It is possible to use a combination of depreciation, bonus depreciation, and Sec. 179 expensing to achieve just about any result for small businesses. Please call if you have questions related to acquiring business assets, including IT equipment, and how it may impact your business’s bottom line.

Don’t Miss Out on Tax Credits

Article Highlights:

• Non-refundable vs. Refundable Credit

• Childcare Credit

• Earned Income Tax Credit

• Child & Dependent Tax Credit

• Saver’s Credit

• Vehicle Tax Credits

• Adoption Credit

• Residential Energy-Efficient Property Credit

Tax credits are a tax benefit that offsets your actual tax liability, as opposed to a tax deduction, which reduces your income. Congress provides tax credits to individual taxpayers for a number of reasons, including as a form of assistance for lower-income taxpayers, to stimulate employment, and to stimulate certain investments, among other things.

Tax credits are a tax benefit that offsets your actual tax liability, as opposed to a tax deduction, which reduces your income. Congress provides tax credits to individual taxpayers for a number of reasons, including as a form of assistance for lower-income taxpayers, to stimulate employment, and to stimulate certain investments, among other things.

Tax credits come in two types: non-refundable and refundable. A non-refundable credit can only reduce your tax liability to zero; any excess is either carried forward or is simply lost. In the case of a refundable credit, if there is excess after reducing your tax liability to zero, the excess is refundable. The following is a summary of some of the tax credits available to individual taxpayers:

Childcare Credit – Parents who work or are looking for work often must arrange for care of their children during working hours or while searching for work. If this describes your situation and your children requiring care are under 13 years of age, you may qualify for a childcare tax credit.

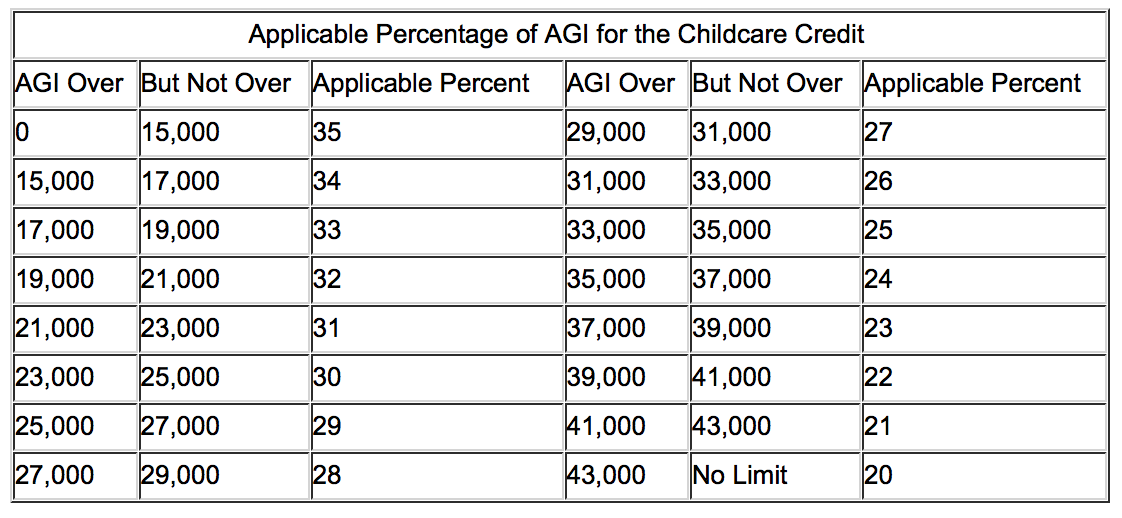

For 2020, The credit ranges from 20% to 35% of non-reimbursed expenses, based upon your income, with the higher percentages applying to lower-income taxpayers and the lower percentages applying to higher-income taxpayers.  The maximum expense amount allowed is $3,000 for one child and $6,000 for two or more, and the credit is non-refundable, which means it can only reduce your tax to zero, and the excess is lost.

The maximum expense amount allowed is $3,000 for one child and $6,000 for two or more, and the credit is non-refundable, which means it can only reduce your tax to zero, and the excess is lost.

As an example, say your adjusted gross income (AGI) is between $33,000 and $35,000. Your credit percentage would be 25%. If you paid childcare expenses of $4,000 for two children under the age of 13, your tax credit would be $1,000 ($4,000 x 25%). If your tax for the year was $5,000, the credit would reduce that tax to $4,000. On the other hand, if your tax for the year was $800, the credit would reduce your tax to zero, and the $200 excess credit would be lost.

This credit also applies when a taxpayer or spouse is disabled or a full-time student, in which case special “earned income” allowances are provided for months when the taxpayer or spouse is disabled or a full-time student. Please call this office for additional details if this situation applies in your case.

Credit Increased for 2021 – The American Rescue Plan Act increases the credit percentage to 50%, based on expenses of up to $8,000 for one child under the age of 13 and $16,000 for two or more. The credit begins to phaseout for taxpayers with AGIs of $125,000. Unlike other years, credit is refundable.

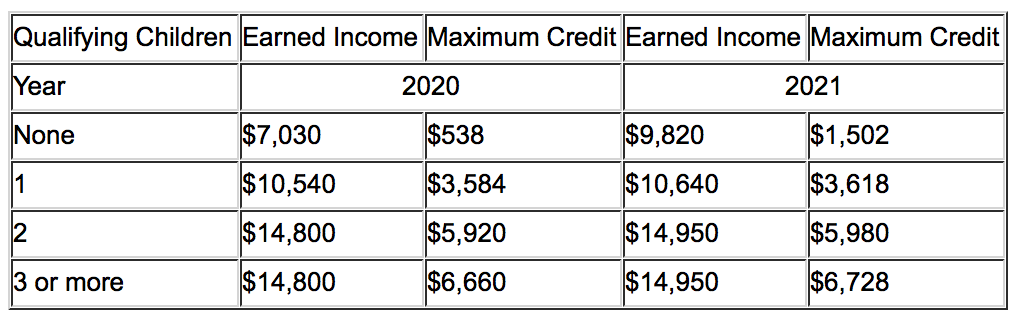

Earned Income Tax Credit (EITC) – Congress established the EITC as an income supplement for working individuals in lower-paying employment. If you qualify, it could be worth as much as $6,660 in 2020. It is a refundable credit.

The EITC is based on the amount of your earned income (income from work for wages and/or self-employment) and whether there are qualifying children in your household.

COVID-19 tax relief legislation passed late in 2020 allows you to elect to use your 2019 earned income to figure your 2020 EITC if your 2019 earned income is more than your 2020 earned income.

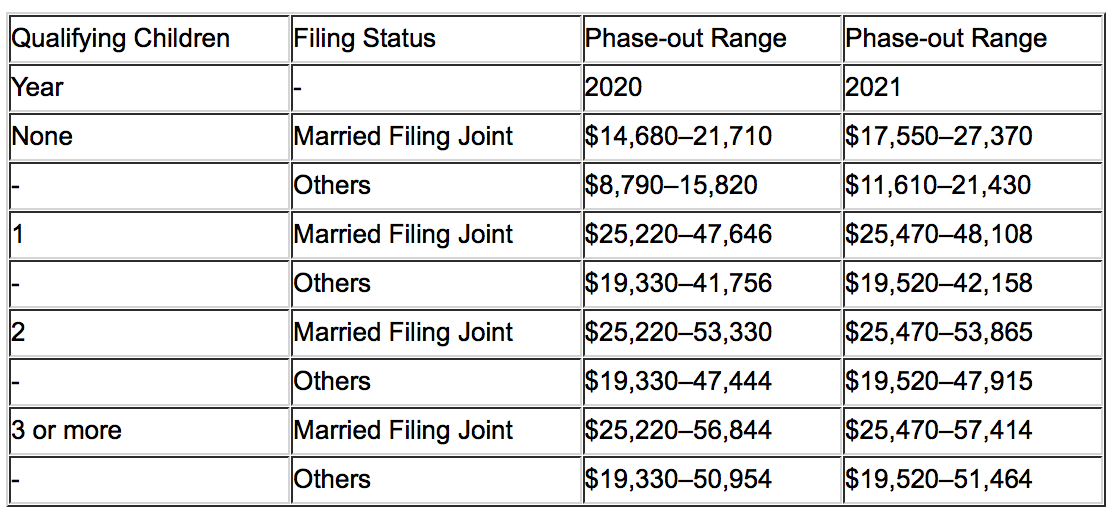

Qualifying children are those who live with you for over half the year, are related, and are under the age of 19 or a full-time student under the age of 24. The credit increases as your earned income increases. The table below shows the earned income at which the maximum credit is achieved for 2020 and 2021.  The credit amount phases out after reaching the maximum based on filing status and number of qualifying children. The phase-out ranges for 2020 and 2021 are shown in the table below.

The credit amount phases out after reaching the maximum based on filing status and number of qualifying children. The phase-out ranges for 2020 and 2021 are shown in the table below.  In addition, there are some qualification requirements: you, your spouse (if married and filing jointly), and each qualifying child must have a valid Social Security number, and you cannot use the filing status married filing separately. You cannot be a qualifying child of another person, your investment income for 2020 cannot exceed $3,650 ($10,000 in 2021) and you cannot exclude earned income from working abroad. If you do not have a qualifying child, you must be at least age 25 but under 65 at the end of the year. However special rules apply for 2021.

In addition, there are some qualification requirements: you, your spouse (if married and filing jointly), and each qualifying child must have a valid Social Security number, and you cannot use the filing status married filing separately. You cannot be a qualifying child of another person, your investment income for 2020 cannot exceed $3,650 ($10,000 in 2021) and you cannot exclude earned income from working abroad. If you do not have a qualifying child, you must be at least age 25 but under 65 at the end of the year. However special rules apply for 2021.

Even though this credit can be worth thousands of dollars to a low-income family, the IRS estimates as many as 25 percent of people who qualify for the credit do not claim it, simply because they don’t understand the criteria. If you qualified for but failed to claim the credit on your return for 2017 (if filed by April 15, 2021), 2018, 2019, and/or 2020, you may still claim it for those years by filing an amended return or an original return, if you have not previously filed. Please call for assistance.

Members of the military can elect to include their nontaxable combat pay in their earned income for the earned income credit. If that election is made, the military member must include in their earned income all nontaxable combat pay they received for the year.

The American Rescue Plan Act – Make a one-year increase in the EITC for childless adults from roughly $530 to $1,502 and to increase the income limit for the credit for these individuals from roughly $16,000 to $21,000. the age cap has been eliminated so that older workers without a qualifying child can claim the credit (currently a childless individual cannot claim the credit after reaching age 65). The legislation also removed the age cap, as well as lower the minimum age to claim the childless EITC from 25 to 19 (except for certain full-time students). Loosened the requirements for child identification numbers for certain childless filers, and for all eligible filers allows 2019’s earned income to be used instead of 2021’s, if 2021’s earned income is less than 2019’s.

Child & Dependent Tax Credit – As an aid to families with children, the tax code provides a child tax credit of $2,000 for each qualified child. A qualified child for this tax credit is one who is under age 17 at the end of the year, is related, is not self-supporting, lived with you over half the year, has a Social Security number, and is claimed as your dependent. The refundable portion of this credit is equal to 15% of your earned income but limited to $1,400. You are also able to claim a non-refundable credit of $500 for each of your dependents who do not qualify for the child credit. For both the child and dependent credits, the credit begins to phase out for married taxpayers with an AGI of $400,000 ($200,000 for others).

The American Rescue Plan Act – For a period of one year, 2021, the credit will include children up through age 17 in the credit, increase the Child Tax Credit to $3,000 ($3,600 for children under the age of 6), make the credit fully refundable.

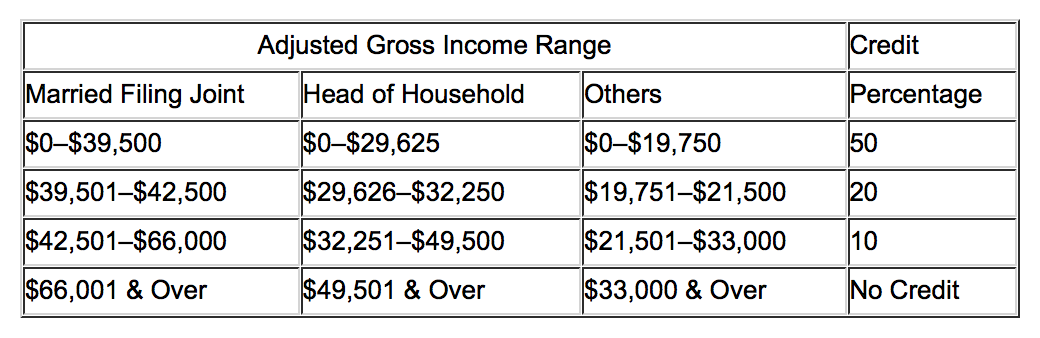

Saver’s Credit – Congress created the non-refundable saver’s credit as a means of stimulating retirement savings among lower-income individuals. It helps to offset part of the first $2,000 that workers voluntarily contribute to traditional or Roth individual retirement arrangements (IRAs), SIMPLE-IRAs, SEPs, 401(k) plans, 403(b) plans for employees of public schools and certain tax-exempt organizations, 457 plans for state or local government employees, and the Thrift Savings Plan for federal employees. The saver’s credit is available in addition to any other tax savings that apply as a result of contributing to retirement plans. The credit is a percentage of the first $2,000 contributed to an eligible retirement plan. The following table illustrates the percentage based upon filing status and AGI for 2021.  Example – Eric and Heather are married, both age 25, and filing a joint return. Eric contributed $3,000 through his 401(k) plan at work, and Heather contributed $500 to her IRA account. Their modified AGI for 2021 was $38,000. The credit is computed as follows:

Example – Eric and Heather are married, both age 25, and filing a joint return. Eric contributed $3,000 through his 401(k) plan at work, and Heather contributed $500 to her IRA account. Their modified AGI for 2021 was $38,000. The credit is computed as follows:  Vehicle Tax Credits – If you are considering purchasing a new car or light truck (less than 14,000 pounds), don’t overlook the fact that Congress allows a substantial tax credit for the purchase of the many electric vehicles currently being offered for sale, providing a tax credit worth as much as $7,500.

Vehicle Tax Credits – If you are considering purchasing a new car or light truck (less than 14,000 pounds), don’t overlook the fact that Congress allows a substantial tax credit for the purchase of the many electric vehicles currently being offered for sale, providing a tax credit worth as much as $7,500.

To be eligible for the credit, you must acquire the vehicle for use or lease and not for resale. Additionally, the vehicle’s original use must commence with you, and you must use the vehicle predominantly in the United States.

Congress did include a phase-out provision for this credit that applies by vehicle manufacturer. The credit begins to phase out once the manufacturer sells 200,000 electric vehicles. To see if the make and model you are considering qualify, visit the IRS website.

The credit is available whether you use the vehicle for business, personally, or a combination of both. The prorated portion of the credit that applies to business use becomes part of the general business credit, and any amount not used on your return for the year when you purchase the vehicle can be carried back to the previous year and then carried forward until used up, but for no more than 20 years. The personal portion is non-refundable.

Adoption Credit – If you are an adoptive parent or are planning to adopt a child, you may qualify for the adoption credit. The amount of the credit is based on the expenses incurred that are directly related to the adoption of a child under the age of 18 or a person who is physically or mentally incapable of self-care.

This is a 1:1 credit for each dollar of qualified expenses up to the maximum for the year, which is $14,440 for 2021 (up from $14,300 for 2020). The credit is non-refundable, which means it can only reduce your tax liability to zero (as opposed to potentially resulting in a cash refund). But the good news is that any unused credit can be carried forward for up to five years to reduce your future tax liability.

Qualified expenses generally include adoption fees, court costs, attorney fees, and travel expenses that are reasonable, necessary and directly related to the child’s adoption, and they may be for both domestic and foreign adoptions; however, expenses related to adopting a spouse’s child are not eligible for this credit. When adopting a child with special needs, the full credit is allowed, whether or not any qualified expenses were incurred.

The credit is phased out for higher-income taxpayers. For 2021, the AGI (computed without foreign-income exclusions) phase-out threshold is $216,660, and the credit is completely phased out at the AGI of $256,660. Unlike most phase-outs, this one is the same regardless of filing status. However, taxpayers filing as married filing separately cannot claim the credit.

Residential Energy Efficient Property (Solar) Credit – This tax credit was created to reward individuals for investing in equipment that uses alternative energy sources to create electrical power for use in a taxpayer’s home or second home. It includes alternative power sources such as fuel cells, wind energy, and geothermal heat pumps, for which the credit expires after 2021.

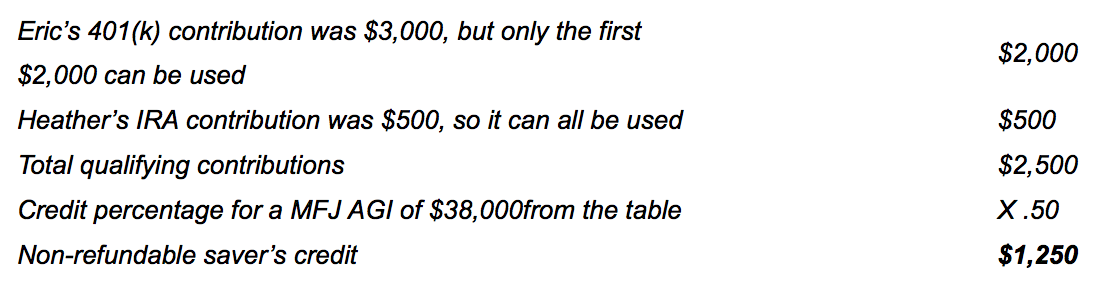

However, the credit is most commonly associated with the home solar credit, which is equal to 26% of the cost of the solar electric system for an individual’s primary and second homes, with no limit on the cost of the solar system. Even though the credit is non-refundable, any amount not used in the first year carries over to subsequent credit years. The credit percentage is phased-out as shown in the table.  Before deciding to add a solar electric system to your home, you need to consider if you can actually afford the system and whether it is worth having one, after taking into account the system’s cost, the financing interest, the reduced electricity costs, and the tax credit. You should make an objective analysis without pressure from a salesperson. These credits are substantial, but the one thing salespeople and contractors typically fail to mention is that the credit is not refundable, and even though it carries over through 2023, there is a good chance you will never use it all. It may be appropriate for you to consult with this office before entering into a contract for a home solar system.

Before deciding to add a solar electric system to your home, you need to consider if you can actually afford the system and whether it is worth having one, after taking into account the system’s cost, the financing interest, the reduced electricity costs, and the tax credit. You should make an objective analysis without pressure from a salesperson. These credits are substantial, but the one thing salespeople and contractors typically fail to mention is that the credit is not refundable, and even though it carries over through 2023, there is a good chance you will never use it all. It may be appropriate for you to consult with this office before entering into a contract for a home solar system.

Electric Motorcycle Credit – Taxpayers that purchase a qualifying electric 2-wheel motorcycle will qualify for a non-refundable credit equal to 10% of the cost, maximum credit $2,500 per vehicle. A qualifying vehicle must meet the following requirements.

• Propelled by a rechargeable battery with a capacity of at least 2.5 kilowatt hours,

• Capable of being re-charged from an external source,

• Highway vehicle capable of 45 mph or more,

• Manufactured primarily for use on public streets, roads and highways,

• Gross weight is less than 14,000 pounds,

• Original use (lease or purchase) begins with the taxpayer, acquired after 2014 and before 2022.

If you have questions or would like additional details related to any of these credits, please give the office a call.

Writing Off Your Business Start-Up Expenses

Article Highlights:

• $5,000 First-year Start-up and Organizational Expense Write-off

• Timely Filing Requirements

• Qualifying Start-up Expenses

• Trade or Business Purchase

• Qualifying Organizational Expenses

• Expense Write-off Limitations

• How to Make the Election

• Other Considerations

Unfortunately, as a result of the COVID pandemic many small firms have gone out of business. Fortunately, with the help of vaccines, new businesses will be opening as the economy returns to near normal. New business owners, especially those operating small businesses, may be helped by a tax provision allowing them to deduct up to $5,000 of the start-up expenses and $5,000 of organizational costs in the first year of the business’s operation. These type of expenses not deductible in the first year of the business must be amortized over 15 years. If a taxpayer who incurred start-up expenses does not make the election, the start-up costs must be capitalized, meaning that the expenses can only be recovered upon the termination or disposition of the business.

Unfortunately, as a result of the COVID pandemic many small firms have gone out of business. Fortunately, with the help of vaccines, new businesses will be opening as the economy returns to near normal. New business owners, especially those operating small businesses, may be helped by a tax provision allowing them to deduct up to $5,000 of the start-up expenses and $5,000 of organizational costs in the first year of the business’s operation. These type of expenses not deductible in the first year of the business must be amortized over 15 years. If a taxpayer who incurred start-up expenses does not make the election, the start-up costs must be capitalized, meaning that the expenses can only be recovered upon the termination or disposition of the business.

Generally, start-up expenses include all expenses incurred to investigate the formation or acquisition of a business or to engage in a for-profit activity in anticipation of that activity becoming an active business. To be eligible for the election, an expense must also be one that would be deductible if it were incurred after the business actually began. An example of a start-up expense is the cost of analyzing the potential market for a new product.

• Qualifying Start-Up Costs — A qualifying start-up cost is one that would be deductible if it were paid or incurred to operate an existing active business in the same field as the new business, and the cost is paid or incurred before the day the active trade or business begins. Not includible are taxes, interest, and research and experimental costs. Examples of qualified start-up costs include:

o Surveys/analyses of potential markets, labor supply, products, transportation facilities, etc.;

o Wages paid to employees and their instructors while they are being trained;

o Advertisements related to opening the business; o Fees and salaries paid to consultants or others for professional services; and

o Travel and other related costs to secure prospective customers, distributors, and suppliers. For the purchase of an active trade or business, only investigative costs incurred while conducting a general search for, or preliminary investigation of, the business (i.e., costs that help the taxpayer decide whether to purchase a new business and which one to purchase) are qualified start-up costs. Costs incurred attempting to buy a specific business are capital expenses that aren’t treated as start-up costs.

• Qualifying Organizational Cost – include fees for legal services, such as for drafting LLC documents, partnership agreements, corporate charter and by-laws; incorporation fees; temporary directors’ fees; and organizational meeting costs.

As with most tax benefits, there is always a catch. Congress put a cap on the amount of expenses that can be claimed as a deduction under this special election. Here’s how to determine the deduction: If the expenses are $50,000 or less, you can elect to deduct up to $5,000 in the first year, plus you can amortize the balance over 180 months. If the expenses are more than $50,000, then the $5,000 first-year write-off is reduced dollar-for-dollar for every dollar in start-up expenses that exceeds $50,000. For example, if start-up costs were $54,000, the first-year write-off would be limited to $1,000 ($5,000 — ($54,000 — $50,000)). These limits are applied separately for the start-up and organizational costs.

The election to deduct start-up and organizational costs is made by claiming the deduction on the return for the year in which the active trade or business begins, and the return must be filed by the extended due date.

The decision to write off these expenses should take into consideration other tax benefits available in the first of year of the business, including bonus deprecation and Sec 179 expensing, and the overall result in the first year of the business. If you are starting a business, it may be appropriate to formulate a business plan in advance. If you have questions or would like an appointment to discuss how to establish your business and the types of business structures that are available, please give this office a call.

How Employee Stock Options Are Taxed

Article Highlights:

• Non-statutory Option

• Wage Income

• Statutory (Incentive) Options

• Capital Gains

• Alternative Minimum Tax

Many companies, as an incentive to employees to help grow the companies’ market value, will offer stock options to key employees. The options give the employee the right to buy up to a specified number of shares of the company’s stock at a future date at a specific price. Generally, options are not immediately vested and must be held for a period of time before they can be exercised. Then, at some later date, and assuming the stock price has appreciated to a value higher than the option price of the stock, the employee can excise the options (buy the shares), paying the lower option price for the stock rather than the current market price. This gives the employee the opportunity to participate in the growth of the company through gains from the sale of the stock without the risk of ownership.

Many companies, as an incentive to employees to help grow the companies’ market value, will offer stock options to key employees. The options give the employee the right to buy up to a specified number of shares of the company’s stock at a future date at a specific price. Generally, options are not immediately vested and must be held for a period of time before they can be exercised. Then, at some later date, and assuming the stock price has appreciated to a value higher than the option price of the stock, the employee can excise the options (buy the shares), paying the lower option price for the stock rather than the current market price. This gives the employee the opportunity to participate in the growth of the company through gains from the sale of the stock without the risk of ownership.

There are two basic types of employee stock options for tax purposes, a non-statutory option and a statutory option (also referred to as the incentive stock option), and their tax treatment is significantly different.

Non-statutory Option — The taxability of a non-statutory option occurs at the time the option is exercised. The gain is considered ordinary income (compensation) and is supposed to be included in the employee’s W-2 for the year of exercise. We say “supposed to be” because it is not uncommon to see smaller firms mishandle the reporting.

The employee has the option to sell or hold the stock he or she has just purchased, but regardless of what he or she does with the stock, the gain, which is the difference between the option price and market price of the stock at the time of the exercise, is immediately taxable. Because of the immediate taxation, most employees who have been granted options will, when exercising their options, immediately sell their stock. Under that scenario, the W-2 will reflect the profit and Form 8949 (the tax form used to report sales of stock and other capital assets) may need to be prepared to show the sale, essentially with no gain or loss, so that the gross proceeds of sale reported on the return are matched up with the sale reported to IRS (on Form 1099-B).

If there was a sales cost, such as a broker’s commission, then the result would be a reportable loss, albeit usually a small amount. Since the difference between the option price and market price is included in wages, it is also subject to payroll taxes (FICA). If an employee chooses to hold the stock, he or she would have to pay the tax on the difference between the option price and exercise price, plus the FICA tax, from other funds. If the stock subsequently declines in value, the employee is still stuck with the gain reported when the option was exercised. Any loss on the subsequent sale of the stock would be limited to the overall capital loss limitation of $3,000 per year.

Statutory (Incentive) Options — What makes the taxation of a statutory option different from a non-statutory option is that no amount of income is included in regular income when the option is exercised. Thus, the employee can continue to hold the stock without any tax liability; and, if he or she holds it long enough, any gain would become a long-term capital gain. To achieve long-term status, the stock must be held for:

• More than 1 year after the stock option was exercised, and

• More than 2 years after the option was granted.

The advantage of long-term capital gains is that they are taxed at lower maximum rates. For example, the capital gains tax rate is 15% for a taxpayer who might otherwise be in the 32% tax bracket.

There is a dark side to statutory options, however. The difference between the option price and market price, termed the spread, is what is called a preference item for alternative minimum tax (AMT) purposes. If the spread is great enough, that might cause the AMT to kick in for the year of exercise. If a taxpayer is already subject to the AMT, this would add to the tax; and, even if not, it might push him or her into the AMT. The current year AMT will be in addition to any tax when the stock is ultimately sold but will establish a higher tax basis for the AMT should it come into play in the year the stock is eventually sold. Not all AMT scenarios can be addressed in this article in detail, so additional guidance may be appropriate.

If the stock is sold before it achieves the long-term holding period requirements described above, the tax treatment is essentially the same as for a non-statutory option.

If you are planning to exercise employee stock options and have questions or wish to do some tax planning to minimize the tax bite, please give this office a call.

Qualified Small Business (QSB) Stock Gain Exclusion: Who Can Take Advantage and How to Do It

Originally, selling stocks identified as having Qualified Small Business status was viewed as offering marginal benefit. But the last several years have seen incremental changes to how gains from the sales of these stocks have been treated. As of the most recent shift, which created a 100% exclusion with certain limitations, these stocks now offer significant opportunities for those who invest in startups and other small businesses.

Originally, selling stocks identified as having Qualified Small Business status was viewed as offering marginal benefit. But the last several years have seen incremental changes to how gains from the sales of these stocks have been treated. As of the most recent shift, which created a 100% exclusion with certain limitations, these stocks now offer significant opportunities for those who invest in startups and other small businesses.

The sale of Qualified Small Business (QSB) stock held for more than five years is addressed under Section 1202. It excludes gains from sales, but only under highly specific criteria and limitations. Tracking the exclusion’s history, stockholders were originally limited to excluding 50% of their gains from the sale of QSB stocks. That number was increased to 75% for shares acquired after February 17, 2009 and before September 28, 2010. Even then, the exclusion was viewed with little enthusiasm, as the gains not excluded were taxed at rates that were much higher than capital gains rates. All that changed when the exclusion was increased again to 100% for shares acquired after September 27, 2010.

There are important limitations to these exclusions: Most notably, for each taxable year, sellers are only permitted to exclude the greater of 10 times the aggregate adjusted bases of the QSB stock or $10 million dollars. Still, even with these limitations, the 100% exclusion has created a virtual tax-exempt gain that has inspired renewed interest in putting money into small businesses and startups. It has provided opportunities for pass-through entities like partnerships to buy and sell QSB stock at the ultimate investor level offered to noncorporate shareholders like trusts, estates and individuals, and this means that their total gain exclusion goes beyond the standard limitations. This means that each partner in a 10-partner group in which each owns 10% of the partnership’s QSB stock with $0 basis for $100 million can exclude their own share of the gain: the total qualifies because it is broken down to the ultimate investor view. Where this is a relatively simple calculation, for others the requirements of section 1202 are likely to create far greater barriers.

Understanding the requirements and considerations involving a QSB

Section 1202 contains many rules for being classified as a QSB, and though this article cannot cover all of them, it will point out important elements that businesses or investors thinking about their own qualifications should consider. Its most elemental criterion is that the business be a domestic C corporation whose aggregate gross assets have never exceeded $50 million through the time that the stock for which the gain exclusion is being sought was issued. Other requirements include:

• Gross asset test Not only is there a requirement that the domestic C corporation not have had aggregate gross assets exceeding $50 million at any point between August 10, 1993 and the time that the stock seeking the QSB exemption was issued, but that limitation holds true for the time period immediately after the stock is issued as well. This is not based on fair market value – instead, gross assets are calculated based on the tax basis of the company’s assets. Still, fair market value is used to assess circumstances involving assets other than cash or when an existing business incorporated into the small business. It’s also important to understand that if a business is a member of parent-subsidiary controlled group, all corporations are treated as a single unit when calculating total gross assets.

• Original issuance requirement In order to qualify for the exemption, the QSB stock shareholder must have first acquired it as an original owner, purchasing it for cash, by providing property, or providing services and obtaining it directly from either the corporation or its underwriter as a qualified shareholder. Buying the stock from another shareholder will not meet the original issuance requirement, and therefore will not qualify the holder of stock for the QSB stock gains exemption, though there are ways to get around this requirement. For example, investors could acquire a target business for the specific purpose of creating a new C corporation, and that would meet Section 1202’s criteria. Similarly, some tax-free incorporations or reorganizations that involve the exchange of QSB stock for stock of another organization may be eligible for exclusion of gains at a later point when the stock is sold.

For those who acquire QSB stock as a gift or by having inherited it, the original issuance requirement will not prevent the realization of the exemption benefit and the same is true of distributions to a noncorporate partner by a partnership as long as the noncorporate partner held its partnership interest when the partnership first acquired the QSB stock. This is a complex issue and many situations – including acquiring the stock as the satisfaction of debt for equity, through cashless warrant exercises, or through convertible debt conversions – should be addressed with our office.

• Active business requirement The issuing corporation is required to be using at least 80% of its assets to operate one or more qualified trades or businesses (QTOB). This is gauged by value, and if more than half of a subsidiary corporation’s stock is owned by the corporation, then that ratable share must be included in the determination of the assets’ value and the percentage of assets being used for business operations.

The rules state that certain fields do not qualify as a QTOB, though whether a business falls into these categories or not may be open to interpretation and can introduce a significant amount of confusion. The fields listed as not qualifying include those involved in law, health, brokerage services, accounting, engineering, financial services, actuarial science, architecture, performing arts, consulting, or athletics.

Additional limitations based on issuer

Even once a shareholder meets the specifications that qualify them for the Section 1202 exclusions, there is an additional limitation based on the issuer of the QSB stock. That limitation is whichever of the following two elements is larger:

• Ten times the aggregate adjusted bases of the QB stock sold by the taxpayer during the taxable year

• $10 million, less the aggregate amount of eligible gain attributed to disposition of stocks issued by the same corporation that the taxpayer realized in a previous taxable year

As previously indicated, the excludible gain that is eligible must have been on sale or exchange of QSB stock owned for more than five years during the taxable year. This is applied at the shareholder level for each investor when the stock is held by a pass-through entity, and this is applied to each investor when calculating the per-issuer limitation. This effectively allows investors in partnerships, whether they are trusts, estates or individuals, to claim a gain exclusion that – when combined – is actually larger than the stated $10 million or 10 times the basis cap limitation. The gain exclusion amount can also be increased by gifting some of the stock in question to family members before the sale.

Summing Things Up

There are a lot of benefits available for those who can take advantage of the Section 1202 gain exclusion on the sale of QSB stock, but the requirements and eligibility criteria are intimidating and complicated. To protect your own interests and make sure that you understand how it applies to you, we urge you to speak with our office before claiming the exclusion for yourself.

The US Loses Out On $1 Trillion a Year Due to Tax Cheats, IRS Estimates

As part of its oversight role, Congress is constantly assessing the economic health of the United States, so hearing from Internal Revenue Service Commissioner Chuck Rettig that the country may be losing up to $1 trillion a year in evaded taxes is an obvious cause for concern. This estimate is several times the 3-year-cumulative amount of $441 billion that the agency had previously asserted.

As part of its oversight role, Congress is constantly assessing the economic health of the United States, so hearing from Internal Revenue Service Commissioner Chuck Rettig that the country may be losing up to $1 trillion a year in evaded taxes is an obvious cause for concern. This estimate is several times the 3-year-cumulative amount of $441 billion that the agency had previously asserted.

In his meeting with the Senate Finance Committee, Rettig said “I think it would not be outlandish to believe that the actual tax gap could approach and possibly exceed $1 trillion per year.” He listed several tax evasion techniques that the agency had not included or even been aware of. Among them were new technologies such as the use of cryptocurrency, as well as more familiar issues such as illegal income, underreporting from pass-through businesses, and offshore tax evasion.

Lawmakers hearing of the disparity between what is collected and what should be collected are vowing to take action. According to Senate Finance Chairman Ron Wyden (Oregon — D) the IRS commissioner’s news should serve as a “wake-up call” to the remarkable revenue losses the government is suffering. He anticipates that his colleagues will take action to facilitate more aggressive tax enforcement, indicating that conversations he has already had with Senator Mike Crapo of Idaho, his committee’s top Republican, indicate bipartisan support. Other senators who have voiced concern include Massachusetts Democratic Senator Elizabeth Warren, who is planning a bill to provide mandatory, steady funding for auditors for the IRS budget; and Ohio Republican Senator Rob Portman, whose focus is on tax-dodging cryptocurrency enthusiasts.

Presidential Action

In addition to congressional action, President Joe Biden has included an extra $900 million in his budget proposal to provide for expanded audits and has included corporate tax enforcement in his $2.25 trillion infrastructure plan. He is also promoting additional individual tax proposals. Responding to questions about what his agency needs to improve enforcement, Commissioner Rettig pointed to 17,000 enforcement-related positions lost over the last ten years and indicated that with $1 billion more in funding, the agency could engage in a multi-year process to update outdated computer systems to flag fraud and tax evasion and hire an additional 4,875 front-line audit personnel. “We want to get there, but we do need your help,” he said. Pointing to the fact that roughly 99% of taxes subject to automatic withholding and reporting are paid while only 45% of those not subject to this oversight are paid, he said that shoring up regulations overseeing tax-return preparers and tax-reporting requirements would close the gap and serve to minimize fraud.

High-Income Individuals and Corporations Hide the Most

According to a recent study, the richest 1% of the American population fail to report or pay taxes on one out of every five dollars that they earn. This evasion is made possible by the fact that income from partnerships, limited liability corporations and other pass-through entities is not automatically withheld in the same way that is done for wage earners. The study’s authors, which include two IRS officials, concluded that eliminating that method of shielding income, as well as offshore structures, would increase the amount of money collected by the IRS by approximately $175 billion each year.

Managing out-of-State Employees: The Payroll Tax Conundrum

As the COVID-19 global health event continues, employees across the country are still working at home and will likely keep doing so for the foreseeable future. If you have employees who live in a different state from where your business is located, this can create additional tax and payroll challenges.

As the COVID-19 global health event continues, employees across the country are still working at home and will likely keep doing so for the foreseeable future. If you have employees who live in a different state from where your business is located, this can create additional tax and payroll challenges.

Here’s what you should know about managing payroll taxes for employees working out of state, with insights from ADP’s recent webinar, Strategies for Surviving Year-End Reporting.

State income tax withholding

When it comes to tax withholding, payroll primarily follows the rules of the state where the work is performed. If employees who live out of state come to your business for work, payroll would follow the withholding rules for the state where your business is located. These employees may owe income tax to their state of residence. Employers often withhold partial amounts for the residence state in addition to the worked-in state, or in some cases the employees handle that themselves when they file their personal income tax returns.

There is an exception when two states have a reciprocity agreement wherein the governments agree that residents only owe income tax to the states where they live, not where they work. If this applies to your workers, you should already be withholding taxes for the state where your employees live. Without a reciprocity agreement, taxes may need to be withheld in both the state in which work is performed as well as the residence state. Check with your state Tax or Revenue Department for details.

Income tax rules for working out of state

If your employees work from home in a different state for number of days that exceeds the established threshold for that state, the employer must generally recognize the change and begin to submit taxes to the state where the employee is working, not where the business is located. This threshold varies by state — for instance, in New York it’s 14 days, but in Illinois it’s 30. Other states have an income threshold, or a combination of time and income.

Another factor some state governments consider is whether the employee is working from home for their convenience or as a necessity for their job. If it’s for the employee’s convenience, then tax withholding should be sourced for the state where the business is located. If working from home is a job necessity, then payroll is sourced through the employee’s state of residence. But state laws and rules vary considerably on the specifics.

Before COVID-19, employers could avoid managing payroll taxes for employees working out of state by having everyone work on site. Now, safety precautions and stay-at-home orders may have forced your organization to account for a multi-state workforce, especially since the pandemic has pushed many employees beyond the temporary thresholds for working from home.

COVID-19 complications

If your business suddenly has employees performing significant out-of-state work due to COVID-19, you may need to register your business with these states to withhold taxes for these employees.

What complicates this matter is that state governments have taken different approaches to the crisis. Some have offered temporary guidance. Alabama and Georgia announced that they would not enforce their payroll withholding requirements for employees who are temporarily working from home in their states due to government-mandated stay-at-home orders.

As another example, Pennsylvania announced that if an employee is working from home temporarily due to COVID-19, the state will not consider that as a change to the sourcing of the employee’s compensation. For non-residents who were working in Pennsylvania before the pandemic, their compensation would remain Pennsylvania sourced income for all tax purposes. For Pennsylvania residents who were working out-of-state before the pandemic, their compensation would remain sourced to the other state and they would still be able to claim a resident credit for tax paid to the other state on the compensation.

However, these rules may not apply depending on whether the states involved have a reciprocal tax agreement. Pennsylvania has reciprocal tax agreements with Indiana, Maryland, New Jersey, Ohio, Virginia and West Virginia.

In addition, some states like Connecticut have ruled that employees working from home due to COVID-19 is a necessity for work, while others, like New York, have ruled that it is for the employee’s convenience. These conflicting rulings mean your business could be in a situation where you need to collect withholding on behalf of two states for an employee working from home.

Another related problem deals with tax “nexus”, which is the concept that where a business has an established presence in a state, it may be required to pay sales, income and other business taxes for that state. In some states, having employees working in the state is enough to establish nexus, which could lead to further tax compliance requirements for your business.

Again, some states have issued guidance to address the effect of COVID-19 and people temporarily working from home. Pennsylvania, for example, will not seek to impose Corporate Income Tax or Sales Tax nexus solely on the basis of this temporary activity. However, this guidance is only in effect until the June 30, 2021, or 90 days after the emergency in Pennsylvania is lifted. In some cases, employers may need to assess whether remote workers are likely to return. If remote work locations are likely to persist, employers may need to consult with Legal and Tax advisors and register with any states in which a legal presence has been or will be established.

New legislation

Even with extra guidance, employers must navigate a wide range of possible laws and payroll requirements, especially if they have employees living in several states. To improve the situation, the federal government is considering legislation that would establish a uniform rule for employees working from home due to COVID-19.

The Mobile Workforce State Income Tax Simplification Act would standardize rules for tax withholding for cross-border employees. For instance, the act would set up a uniform threshold of 30 days of at-home work before withholding laws would apply. The HEROES Act and HEALS Act proposals both contain provisions for this issue as well, but Congress is still debating these bills.

Payroll compliance Unless state laws are changed and/or the federal government standardizes the rules, employers need to understand and comply with their regional requirements around managing payroll taxes for employees working out of state. Organizations will also need to understand the possible nexus impact on their business. To accomplish these objectives, consider speaking with a legal and payroll expert who is on top of the latest state laws. They can help you update your payroll system to manage the new requirements as your employees continue working from home.

This story originally published on SPARK, a blog designed for you and your people by ADP®.

How to Protect Your Data in QuickBooks

After the unprecedented year we’ve just experienced, the last thing you need is to have your accounting data compromised or stolen. It would be impossible to reconstruct your QuickBooks file from scratch, and you can’t afford to have a hacker steal any of your funds.

After the unprecedented year we’ve just experienced, the last thing you need is to have your accounting data compromised or stolen. It would be impossible to reconstruct your QuickBooks file from scratch, and you can’t afford to have a hacker steal any of your funds.

There are numerous steps you can take to protect yourself from threats, both internal and external. QuickBooks itself offers some safeguards. Strong company policies can also help safeguard against data theft or destruction. And some of your security guidelines should just come from using common sense.

Here’s a look at what you can do.

Keep Your Systems Safe

There are countless ways you can protect your data by maintaining the integrity of the computer that’s running QuickBooks. Some involve the same steps you would take to safeguard all of the applications and information you have stored there. You should have reputable antivirus/anti-malware software installed. Use strong passwords. Keep up with system updates.

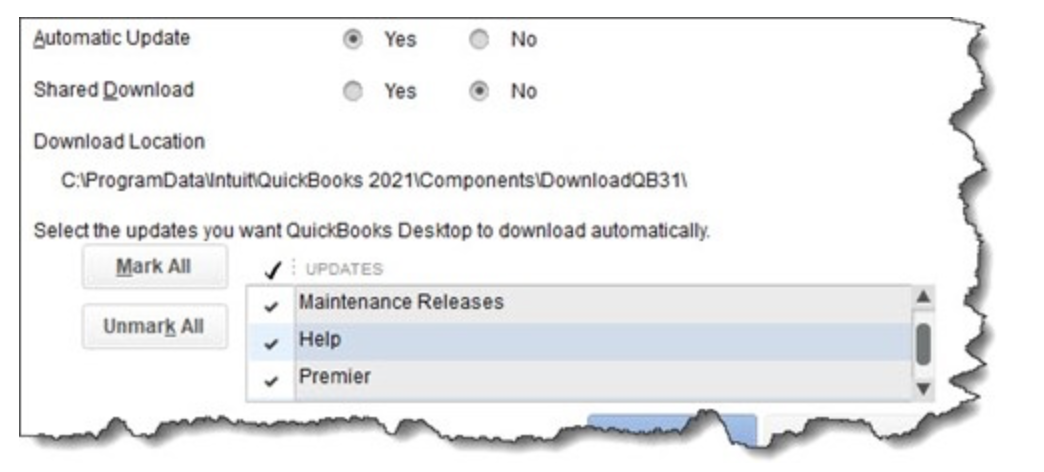

You can set up automatic updates in QuickBooks to download and install new functionality and bug fixes.

Updates and Backup

QuickBooks’ own updates are critical, too. You can start these manually, but we recommend setting up automatic updates. Open the Help menu and click on Update QuickBooks Desktop. Click the Options tab to access this tool.

Frequent, safely-stored backups are another essential element of overall data security. If your system is compromised by an intruder, you’ll need to be able to restore your most recent QuickBooks file when it’s safe again. Go to File | Back Up Company to set up either a local or an online backup. Use one of these tools at the end of any day you’ve entered anything on QuickBooks. We can help you with backup if you’re not absolutely sure how to do it.

Networks and Smartphones

If you have multiple PCs that run on a network, it’s important to maintain that system’s health, too, since an intrusion at one workstation can affect everyone. You can do this by:

• Discouraging employees from browsing the web excessively and downloading unnecessary software.

• Encouraging responsible handling of emails (no clicking on unknown attachments, no personal email on work computers, etc.)

• Installing network monitoring software or hiring a managed IT service that only charges when you need them.

Do your employees have company-issued smartphones? Make sure their security systems are sound. Set policies to protect them. For example, tell employees they should never use them on a public Wi-Fi network or install personal apps on them.

Internal Fraud Possible

No business owners anticipate that their own employees would steal from them. But it happens, and it can do tremendous financial damage. So minimize your chances of being victimized by limiting the access that employees have to sensitive information.

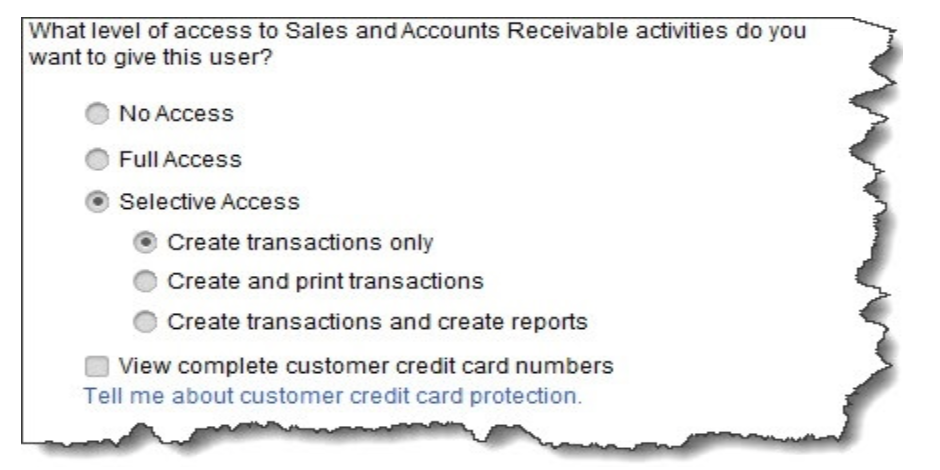

You can limit the access permissions each user has in multiple areas.

Go to Company | Set Up Users and Passwords, then click Set Up Users. You should be listed there as the Admin. Click Add User and supply a username and password. If you’re not sure how many users are supported on your license or need to add more, contact us. Click Next and then click the button in front of Selected areas of QuickBooks. Click Next again. On the next several screens, you’ll designate that user’s access in areas including Purchases and Accounts Payable and Checking and Credit Cards. When you come to the end of the wizard, click Finish.

You might consider running a background check when you hire someone who will have access to QuickBooks. It’s become a more common business practice.

QuickBooks provides additional tools that can be helpful in tracking down suspicious activity. You can view the Audit Trail, for one. Go to Reports | Accountant & Taxes | Audit Trail. This report displays a comprehensive list of transactions that have been entered and/or modified. There are other reports that may be helpful, like Missing Checks, Voided/Deleted Transactions, and Purchases By Vendor.

A Never-Ending Process It’s so easy to get caught up in the daily work of running your business that you forget to take the steps required to keep your QuickBooks data—and all of your computer hardware and software—safe. We get that.

Further, you might think that you’re an unlikely target because you’re a small business. Hackers count on you thinking that, though the reality is that you don’t have to be a big corporation to be the victim of cybercrime. Whether or not criminals get access to your funds, they can do a lot of damage that will end up costing you more time and money than you might think.

So stay vigilant. Security should be considered whenever you deal with financial transactions — especially where the internet is involved. If we can be of assistance as you set up safeguards and company policies, let us know. As always, we’re available to answer any questions you might have about QuickBooks operations in general.

Entrepreneur Success Stories: Zapier

Success leaves clues.

Zapier is a software company founded in 2011 by Wade Foster, Bryan Helmig, and Mike Knoop. Zapier provides a service which helps end users automate the integration of online applications that they use.

Let’s take a look at a behind the scenes software integration company that has taken the industry by storm.

HOW ZAPIER GOT THEIR START Before becoming a company valued at over $5 billion, Wade Foster (CEO) and Bryan Helming (CTO) were members of a jazz quartet, playing gigs together in their hometown of Columbia, Missouri.

In addition to their love for music, they discovered that they both also had a passion for creating web applications and began working on projects together.

In September 2011, they came up with an idea that would change the course of their lives. They decided to start a company that helped end users to integrate two different software applications. To help get their idea off the ground, they enlisted a third co-founder, Mike Knoop (CPO) and went to work.

They created the first iteration of their software application (known then as API Mixer) and entered a local start up competition. Their idea won, and they knew they were on to something.

They continued to develop their idea and submitted it to Y Combinator, where they were initially rejected. Foster, Helmig, and Knoop refused to take no for an answer and continued to submit their application to Y Combinator, until they were finally accepted in 2012. At that time, the project included integrations with 34 applications. Today, that number is over 3,000 integrations, and they have more than 300 application partners.

During their early stage, they were able to secure $1.3 million in Series A funding from investors and within two years, they reached profitability. This was the only venture capital funding that they’ve accepted thus far, though they have received numerous offers along their journey.

Zapier has gone on to be awarded the #1 company in the early-stage category as evaluated by top venture funds in the industry.

KEYS TO SUCCESS

Going from zero to a $5 billion company within a decade is no easy feat. Zapier’s success can be attributed to many of the decisions that the founders have made along the way.

Building Relationships with the Zapier User Base

Zapier believed that building relationships were crucial to helping them to build and grow their user base. Foster, Helmig, and Knoop started out by visiting online forums of larger software applications such as Dropbox and Basecamp and seeking users who were frustrated with their inability to use the functionality of one application along with another, often times having to repeat the same tasks across applications. The Zapier team would reach out to these users and offer to help them resolve their issue. In the early stages of the company, this how they generated their first customers. Customer service continues to be a foundational part of who Zapier is as a company.

Customer-Centric Values

As an employee of Zapier, each team member will participate in the customer support function. Whether an employee is in HR or IT, the founders believe that hearing first-hand about how customers are experiencing the product and understanding their frustrations will help to create a better products and experience.

Teamwork is Key

Zapier has been a remote company since its founding. With team members across the company and the globe, it is important for them to be able to communicate with one another to ensure each team member is on the same page. They do this by sharing information across multiple channels and multiple times to ensure that important ideas are communicated. Transparency is one of their keys to success.

Tell the Customer’s Story

As the function of the Zapier software is to connect other software applications, the company will not be front-of-mind if working properly. As a result, Zapier has had to be very deliberate in how they reach out to current and potential customers.

One part of their marketing efforts through their blog is to share the success stories of their clients. Zapier interviews customers, identify pain points that have been resolved through the application and uses this as a guide to assist other customers who might be experiencing the same issue.

This attention to detail in addressing customer concerns and success has helped the company grow from its first customers back in 2012 to their current user base of over 600,000 users.

Zapier’s success reveals how dedicated client focus can have a huge impact on the bottom line.

If you have any questions about turning your business into a success story or you would like to learn more about our services, please feel free to contact us for more information.

May 2021 Individual Due Dates

May 10 – Report Tips to Employer

May 10 – Report Tips to Employer

If you are an employee who works for tips and received more than $20 in tips during April, you are required to report them to your employer on IRS Form 4070 no later than May 1110. Your employer is required to withhold FICA taxes and income tax withholding for these tips from your regular wages. If your regular wages are insufficient to cover the FICA and tax withholding, the employer will report the amount of the uncollected withholding in box 12 of your W-2 for the year. You will be required to pay the uncollected withholding when your return for the year is filed.

May 17 – Individual Tax Returns Due

File a 2020 income tax return (Form 1040 or 1040-SR) and pay any tax due. If you want an automatic extension of time to file the return, please call this office.

Note: The normal due date for individual returns is April 15. However, the IRS extended it to May 17.

Caution: The extension gives you until October 15, 2021 to file your 2020 1040 or 1040-SR return without being liable for the late filing penalty. However, it does not avoid the late payment penalty; thus, if you owe money, the late payment penalty can be severe, so you are encouraged to file as soon as possible to minimize that penalty. Also, you will owe interest, figured from the original due date until the tax is paid. If you have a refund, there is no penalty; however, you are giving the government a free loan, since they will only pay interest starting 45 days after the return is filed. Please call this office to discuss your individual situation if you are unable to file by the May 17 due date.

May 2021 Business Due Dates

May 10 – Social Security, Medicare and Withheld Income Tax

May 10 – Social Security, Medicare and Withheld Income Tax

File Form 941 for the first quarter of 2021. This due date applies only if you deposited the tax for the quarter in full and on time.

May 17 – Employer’s Monthly Deposit Due

If you are an employer and the monthly deposit rules apply, May 17 is the due date for you to make your deposit of Social Security, Medicare and withheld income tax for April 2021. This is also the due date for the non-payroll withholding deposit for April 2021 if the monthly deposit rule applies.